nebraska sales tax calculator vehicle

Whether or not you have a trade-in. -Click the OK button below to begin.

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax and Tags Calculator.

. Request a Business Tax Payment Plan. Also effective October 1 2022 the following cities. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions.

The county the vehicle is registered in. The cost of a car. Nebraska DMV fees are about 765 on a 39750 vehicle based on a.

The Nebraska state sales and use tax rate is 55 055. The percentage of the Base Tax applied is reduced as the vehicle ages. L Local Sales Tax Rate.

Registration Fees and Taxes. Sales and Use Tax. Maximum Possible Sales Tax.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The cost to register your car in the state of NE is 15. Maximum Local Sales Tax.

-Click the Info button for additional information on how to use this site. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The type of license plates requested.

Omaha Ne Sales Tax Calculator. Just enter the five-digit zip code of the location in. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger.

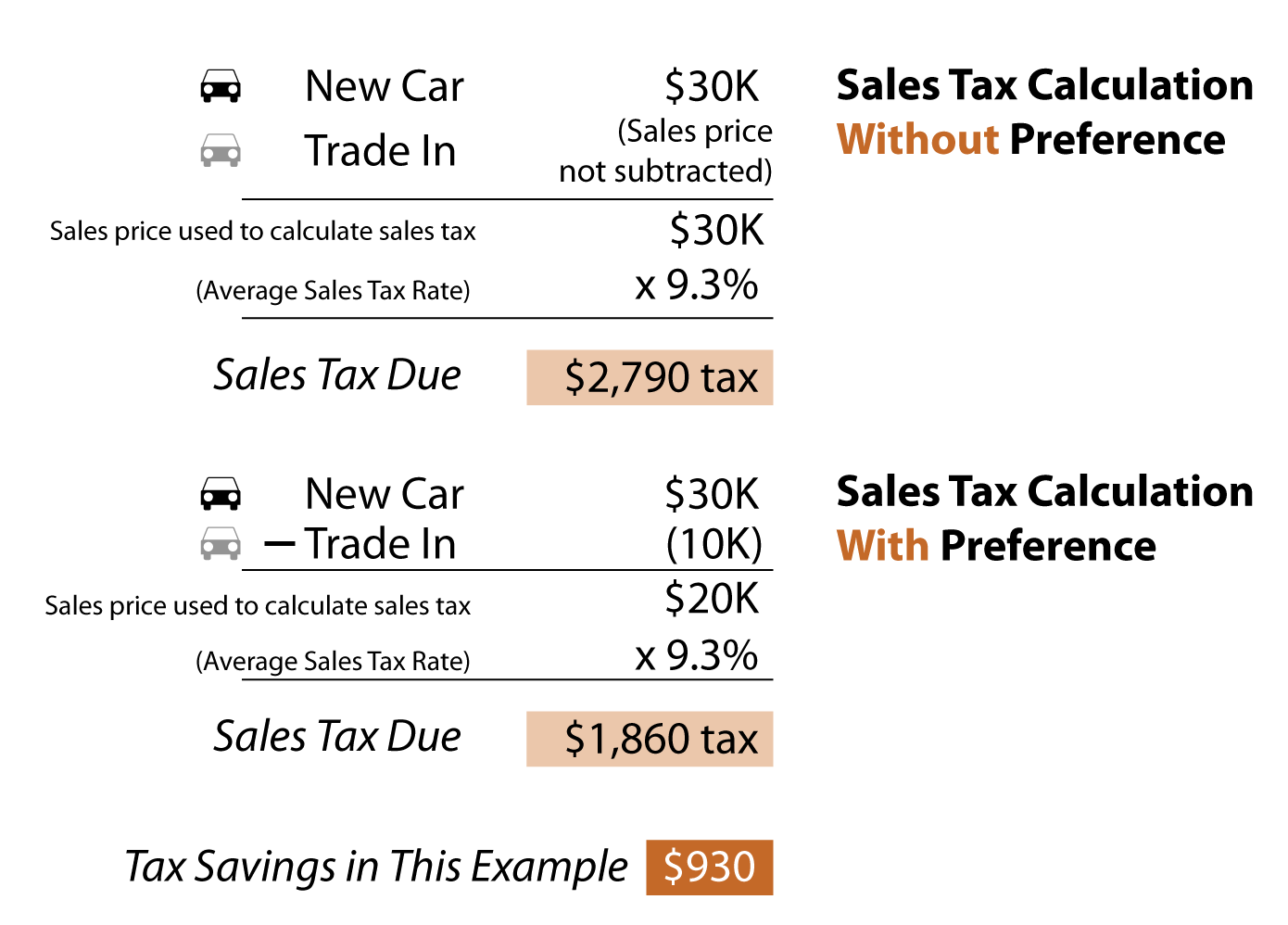

With local taxes the total sales tax rate is between 5500 and 8000. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Nebraskas motor vehicle tax and fee system was implemented in 1998.

The Nebraska sales tax on cars is 5. Sales Tax Rate Finder. Nebraska State Sales Tax.

Money from this sales tax goes towards a whole host of state-funded projects and programs. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. Make a Payment Only.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Some localities collect additional local fees and taxes. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

The Nebraska state sales and use tax rate is 55 055. For vehicles that are being rented or leased see see taxation of leases and rentals. New car sales tax OR used car sales tax.

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. The state in which you live. Nebraska Department of Economic Development.

1st Street Papillion NE 68046. Nebraska car tax is 285943 at 700 based on an amount of 40849 combined from the sale price of 39750 plus the doc fee of 299 plus the extended warranty cost of 3500 plus the GAP charge of 1000 minus the trade-in value of 2200 minus the rebate of 1500. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Contact your County Treasurers office for more information. Driver and Vehicle Records.

Prepaid maintenance is taxable in Nebraska and can be included on the warranty line of the calculator for accurate handling. Average Local State Sales Tax. Nebraskas motor vehicle tax and fee system was implemented in 1998.

Provide feedback or submit. The Nebraska sales tax on cars is 5. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. -Click the Sales Tax Search button to search by address and print a report including the address you entered the rate provided by the Nebraska Department of Revenue and the date the information is entered. Via email from the Sarpy County Treasurers Office.

How Does Sales Tax Apply to Vehicle Sales. Registration is required with each vehicle purchase to establish ownership and link the car to the purchaser. You can find these fees further down on the page.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Before that citizens paid a state property tax levied annually at registration time.

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

7 Sales Tax Calculator Template

Dmv Fees By State Usa Manual Car Registration Calculator

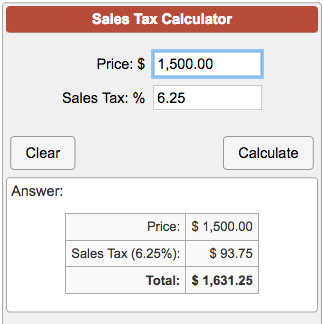

Item Price 29 99 Tax Rate 6 25 Sales Tax Calculator

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax On Cars And Vehicles In Nebraska

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Woocommerce Sales Tax In The Us How To Automate Calculations

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Sales Tax Calculator Credit Karma

Nebraska Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com